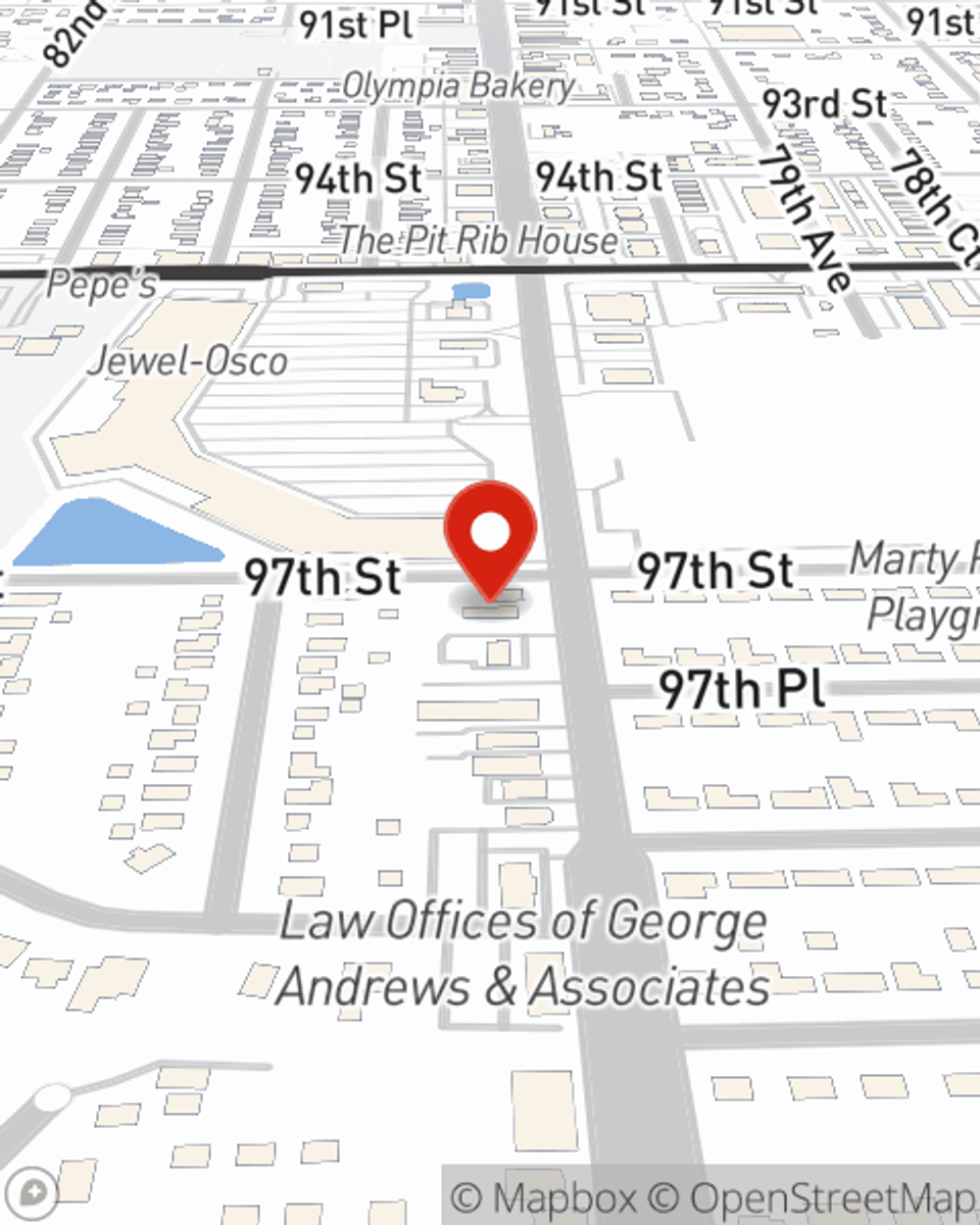

Business Insurance in and around Palos Hills

Palos Hills! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Your Search For Remarkable Small Business Insurance Ends Now.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Mark Trennert. Mark Trennert gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Palos Hills! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

If you're looking for a business policy that can help cover extra expense, accounts receivable, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

At State Farm agent Mark Trennert's office, it's our business to help insure yours. Call or email our excellent team to get started today!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Mark Trennert

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?